Preparation is key to any project or endeavor, and payer contract negotiations are no different. If you don’t have your ducks in a row including your fee schedule pricing demands and arguments, you could be shut down before you’re even out of the gate.

The fee schedule portion of your payer contract outlines the rate at which you’ll be reimbursed for your services. It is the very core of the contract. Therefore, establishing what pricing you want before you begin the negotiation process is one of the most important preparations you’ll make. So this is not a task to take lightly. Take the below steps to prepare for negotiating your fee schedules with payers.

Determine Your Revenue Per Visit to Negotiate Fee Schedules

You’ll need a reimbursement baseline to know what rates to demand during your negotiations. When setting your bottom-line rates, consider the profits you want to realize, and determine what price points you’ll need to meet that goal. Then, analyze what rates you are currently receiving by analyzing the amount you make per patient visit.

Here’s how: You can do this by taking the total dollars you received during the last 12 months and dividing this amount by the total number of patient visits during the same time period. For example, if your practice earned $1.2 million last year and your practitioners handled 12,000 office visits in that time, your per-visit revenue is $100. Use this calculation as a starting point to determine what results you hope to achieve under the payer contract.

Factor Your Demographics in Fee Schedule Setting

You should also consider the general economics of the area you serve. If your practice is in a financially depressed area, patients cannot afford high fees. Conversely, if your practice provides plastic surgery in Beverly Hills, your patients can likely afford higher fees. Your practice’s — for instance, neurosurgery or orthopedics — should also affect your price-setting.

Focus on Higher Reported, Priced Fee Schedule Items

As you gather data about your practice, one key element to consider is your most-often reported and highest-reimbursed procedures and services. Therefore, you should review your top codes and determine which ones are driving your practice’s revenue. This will allow you to focus your negotiations on those services and procedures that will have the biggest impact on your practice’s bottom line.

Many experts suggest using the 20/80 rule: Focus on the 20% of codes that generate roughly 80% of your revenue. The typical practice fee schedule for a commercial payer has as many as 500 codes, but the practice typically bills only 20 to 40 of these on a regular basis. Consequently, you don’t want to spend your time on reviewing codes that barely affect your practice’s income.

Warning: Be careful if a payer starts to argue that you’re being reimbursed, for example, at an average of 160% of Medicare. They are likely quoting from across your fee schedule of 500 codes or more. When you examine the codes you’re reporting most frequently, you may find that these specific services and procedures are paid at 90% of Medicare. You really need to look at the codes that drive your practice’s income to have a clear picture of how the contract will affect the practice’s overall revenue.

Compare Payers’ Rates for Calendar Year

In addition, a good rule of thumb is to examine the billing for a 12-month period. This can be a rolling 12 month or a calendar year — your choice. Just be sure to keep the time period consistent across all the payers you are considering so that you make a true comparison.

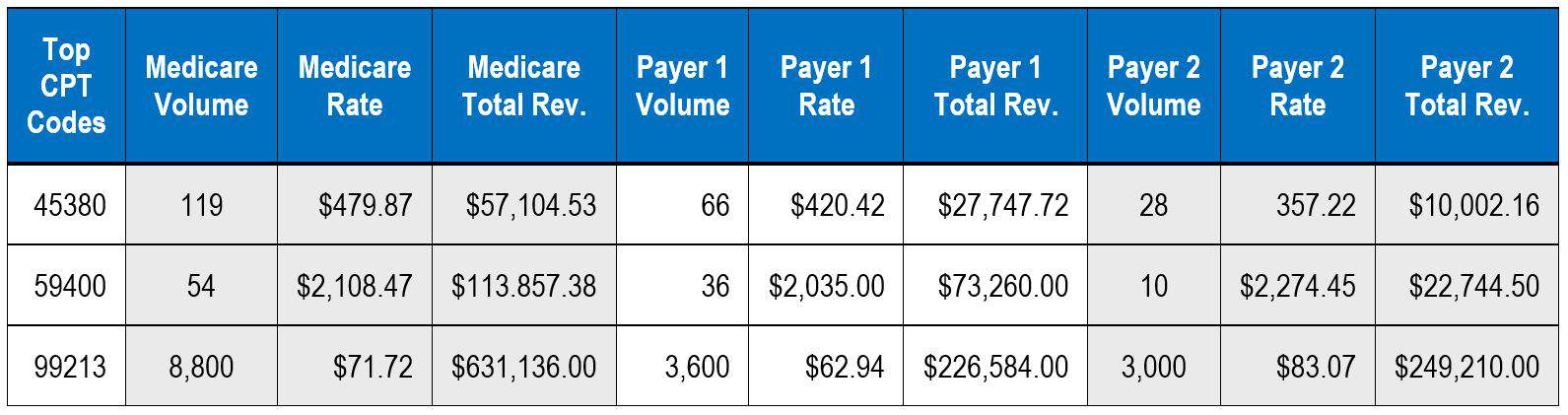

You should compile this data for each of your payers so you know exactly what items may require additional negotiation. Although Medicare does not negotiate rates, you should still include it as a benchmark, because it stands as a good baseline when comparing payers. For example, your data may look like this:

This allows you to more readily identify those services and procedures that have the biggest impact on your practice’s bottom line. You’ll then know which of these to focus on when it’s time to negotiate.

Tip: When setting your contracted fees for services and procedures, make sure your billed charges are higher than your contracted charges. Payer contracts often include a clause that allows them to pay the lesser of your billed or contracted charge. So if you’re billing patients at a lower rate than you’ve contracted with your payer, the payer can choose to pay the lower billed charge rather than the one they’ve contracted with you to pay. This could significantly undermine your income forecasting.

Sign Up for Payer Contract Negotiations Online Training

-

Negotiate Payer Contracts to Get Paid More of What You’re Due$277.00 – $917.00

Negotiate Payer Contracts to Get Paid More of What You’re Due$277.00 – $917.00 -

Get Paid More for Out-of-Network Patient Services$247.00 – $257.00

Get Paid More for Out-of-Network Patient Services$247.00 – $257.00 -

Get Closed Insurance Panels to Open Their Doors$277.00 – $917.00

Get Closed Insurance Panels to Open Their Doors$277.00 – $917.00