CMS and private payers have recently implemented a variety of prior-authorization, copay and cost-sharing billing waivers for the COVID-19-related services you supply to your patients. Many of the services included in these waivers are being made available to patients at no cost. This helps prevent the inability to pay for services as a barrier to receiving the care they need.

For you and your patients to benefit from these waivers, you must comply with specific requirements. Fail to do so and you’ll face false claims violations down the road. These violations could lead to massive financial penalties depending on the extent of the compliance infraction.

Taking advantage of these waivers will most certainly help your patients receive the care they need, and improve your ability to be better reimbursed for the services you provide – when you need it most. However, it’s important that you heed the specific conditions of each waiver (i.e. confirmed COVID-19 diagnosis (U07.1), certain telehealth services and testing, etc.).

Why this matters: You usually can’t reduce or waive co pays or deductibles of Federal Health care programs without violating Federal anti-kickback statutes.

Before the waivers, failure to comply with patient cost-sharing requirements —such as coinsurance and deductibles—could lead to penalties from the Office of Inspector General (OIG) . Now, the OIG has stated that they will not penalize physicians and other practitioners for waiving or reducing a beneficiary’s cost-sharing obligations for telehealth services during the COVID-19 Declaration.

TAKE CAUTION – this non-penalty language is not an open ticket to waive costs. Prosecutions of false claims that don’t meet these newly implemented requirements have already started, reports healthcare attorney and practice expert, Heidi Kocher, B.S., M.B.A, J.D., CHC. “After the pandemic ends, I expect they will increase further.”

To avoid future penalties, it’s imperative that you CORRECTLY waive co-pays ONLY when you should. “Pay close attention to the effective dates as they are constantly changing and be ready to clean up your billing as needed,” warns Kocher in her top-rated training “Avoid Post-COVID-19 Trouble: Comply with CMS Copay Waivers.”

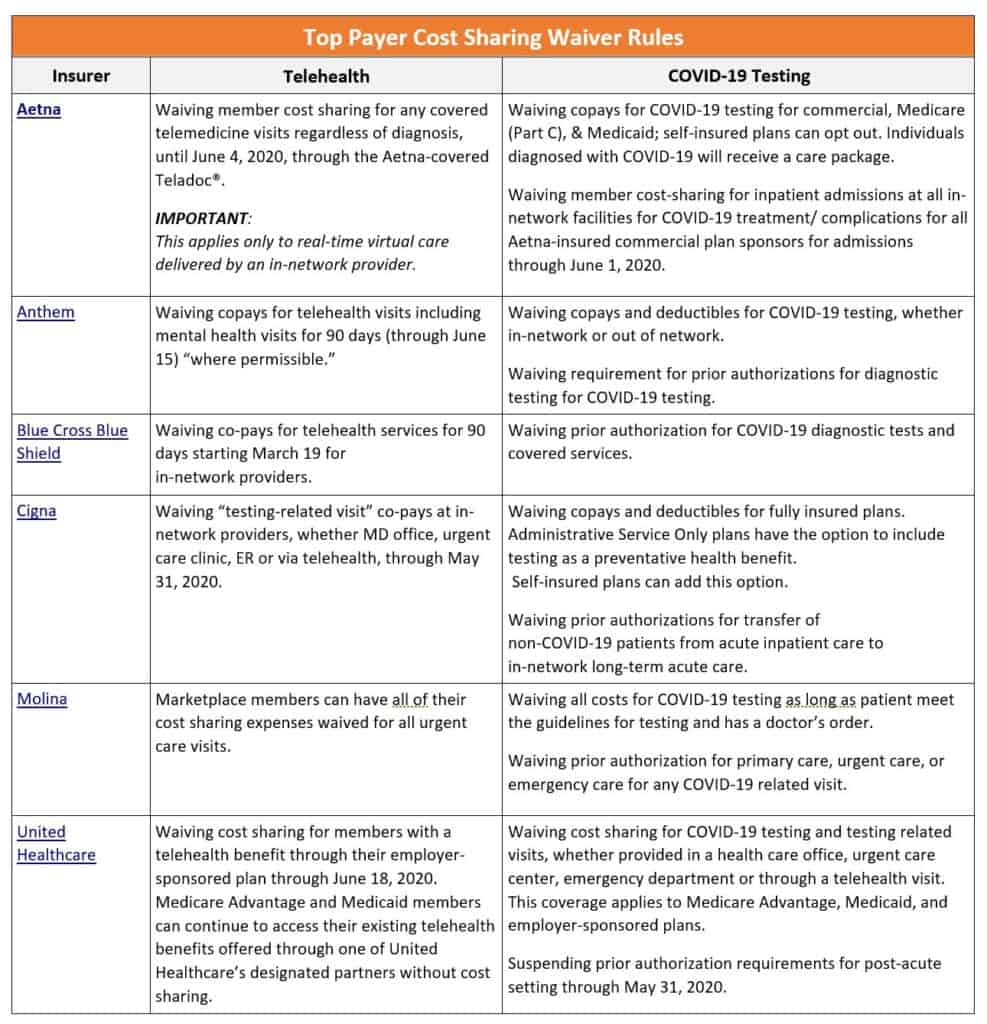

The below chart has a sampling of coverage requirements from of top insurers for prior authorization, eligible services, etc. You can use the below chart to help you correctly charge your patients, and to avoid having to payback penalties in the future. If your specific payer is not listed on the chart below, contact them to get their requirements as soon as possible. It is the only way to avoid the headache and financial paid of getting it wrong.

Beware: This article only provided input on billing waivers. Itis not an exhaustive list of billing guidelines. There are also numerous requirements for modifiers, frequency limitations, and compliance documentation you need to follow to support your compliant billing of waived services.

The good news is that you don’t have to face these rule modifications alone. Heidi provides you with a step-by-step guidance related to exactly how you can comply with these new rules in her top-rated session “Avoid Post-COVID-19 Trouble: Comply with CMS Copay Waivers” that received a 4.5 out of 5 star review.

Additional COVID-19 Resources For Your Practice

|

|

|

||||||||

| . | ||||||||||

| Avoid Post-COVID-19 Trouble: Comply with CMS Copay Waivers | Telehealth Supervision: Boost NPP Services Payup During COVID-19 | Use Time to Get Paid More for Your E/M Services | ||||||||

|

|

|