You received your HHS Provider Relief Fund (PRF) money, now what? PRF Allowable Expenses.

Well, depending on your reporting Period deadline, you must submit detailed data on how you used your PRF money. There are numerous calculations you must correctly tabulate before submitting your data to HHS. One of these is figuring out which payroll/employee costs are eligible in the PRF Allowable Expenses calculation.

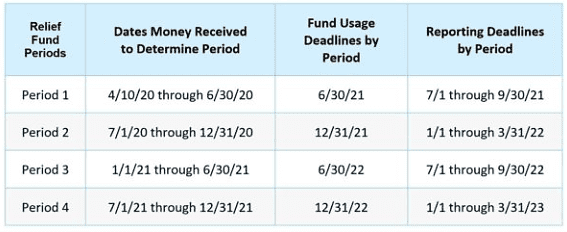

To start, you must make sure you know your reporting Period. This is set based on the date you received your Provider Relieve money. HHS included the following chart on their Reporting Requirements and Auditing page of their website (slight edits have been made to the column headers for ease of use):

PRF Allowable Expenses Staff Breakdown

Figuring out which costs can be included with calculating your PRF Allowable Expenses can be confusing and complicated. To help you submit your data correctly, check out the Q&A below. Questions were submitted by attendees to a recent online training, Portal Reporting Tactics to Keep Your HHS Provider Relief Money, presented by healthcare attorney, a Amanda Waesch, Esq.

Here are Amanda’s answers to attendee questions related to PRF Allowable Expenses for payroll/employees:

Q1. “Is the incremental increase of our 401K match amount for 2019 vs. 2020 a PRF allowable expense?”

A1. It is unlikely that you will be able to include these expenses in your allowable expense calculation. US department of Health and Human Services (HHS) has been very clear in all of its communications, both in its FAQs and verbally, that it is your responsibility to show how the expense is used to prepare for, prevent or respond to COVID-19. Accordingly, to make it possible to include these expenses, you must be able to they meet these criteria.

Q2. “Can we include COVID-related payroll bonuses paid in 2021 into our PRF allowable expenses calculation? We received our HHS money in Phase 1.”

A2. If you received your Provider Relief Fund (PRF) money in Phase 1, you will likely be reporting during HHS’ Reporting Period 1. If this is the case, your eligible expenses must be incurred between January 1, 2020 through June 30, 2021. Therefore, you have 18 months to incur and pay for eligible expenses. In this case, you must pay the payroll bonus before June 30, 2021 to make it eligible for inclusion.

Q3. “We received our Provider Relief money in May 2020. We paid hazard bonus pay to our staff on June 21, 2021, which wiped out the HHS money we received. Can we just report hazard pay and nothing else when calculating our PRF allowable expenses?

A3. Yes. Based on the date you received your money you are probably reporting in Period 1. Accordingly, you must use your PRF money by June 30, 2021. When you report your fund usage into the HHS portal, you are required to include eligible expenses first. If you submit sufficient expenses that exceed the PRF money you received, you should not have to report on lost revenues (because you applied all of your PRF money toward COVID expenses).

Q4. “If our leadership stopped all other projects to address COVID operations, can we include their full salary in our COVID-related PRF allowable expenses?”

A4. Check out HHS’ FAQ to confirm the correct course of action based on your situation. With that said, as long as you keep sufficient supporting documentation that your leadership team’s attention to COVID-related matters is not merely a lost opportunity you should be able to include their full salaries. It is important that you keep detailed supporting documentation to tangibly tie your leadership team’s costs directly to COVID (and not merely lost opportunity).

Q5. “Is hazard pay/bonuses in the form of gift cards allowable to include when reporting our PRF allowable expenses?”

A5. There are two separate issues related to this question. (1) To be eligible for inclusion, you would report that the funds in question were used to purchase gift cards to provide employees with hazard pay/bonuses during the pandemic. (2) There may be additional payroll implications related to this issue. To be sure you handle things correctly, you should check with a payroll expert or contact your legal counsel.

The questions and answers above were a part of a complimentary online report, HHS Provider Relief Funds Reporting Portal Rules – Answers to Your Most Challenging Questions. You can download the complete report at no cost at no cost. It contains over 70 questions and answers to help you submit your HHS PRF reporting correctly the first time.

| Subscribe to Healthcare Practice Advisor | |

| Get actionable advice to help improve your practice’s reimbursement, compliance, and success in this weekly eNewsletter. |

|

|

|