Creating compliant good faith estimates for self-pay and uninsured patients means more than just handing patients a form with a number on it. You must also master the timing of the estimates you distribute—and if you don’t, the government could fine your practice. Why? Because the estimate needs to give the patient enough time to make an informed decision about whether they want to follow through with the service based on the estimated cost they’ll incur.

Check out the most important timelines for good faith estimates that every practice should know to stay compliant with the No Surprises Act.

Master the 10:3:1 Rules

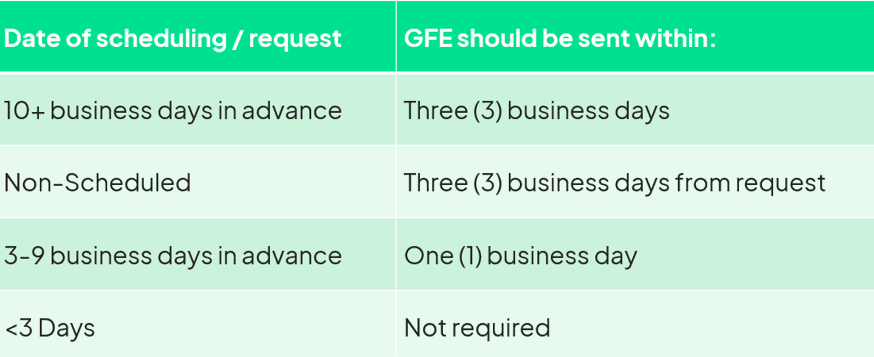

The government has specified exactly how many days you have to give patients the good faith estimate of how much their service or item will cost, but it’s not just a matter of adhering to one timeline across the board. Instead, there are a few nuances to how you time the estimates, which some experts refer to as the “10:3:1 Rule.” Following are the most important elements to follow as part of this regulation:

- If the patient schedules the item/service three to nine days before the appointment: You must provide the good faith estimate no later than one business day after scheduling.

- If the patient schedules the item/service at least 10 days before the appointment date: You must provide the good faith estimate no later than three business days after the patient schedules the appointment.

- If the patient requests a good faith estimate but hasn’t scheduled an appointment: You must provide the good faith estimate no later than three days after the request.

- If the patient schedules the item/service fewer than three days prior to the appointment date: You are not required to provide the patient with a good faith estimate. However, many practices still choose to send one out as soon as possible as part of a good patient relationship program.

Consider using the following chart as a guide as you navigate the timelines:

Don’t Forget to Update the Estimate When Necessary

Another important timeline to remember is that the good faith estimate you issue to a patient is valid for 12 months. If you end up changing the expected charges, items, services or costs that you put on an estimate within that 12 month period, you must send the patient an updated good faith estimate at least one business day before you’re scheduled to provide the patient with the service or item. If you don’t, you must honor the initial good faith estimate that you sent the patient.

Seeking more information about creating compliant good faith estimates? Check out the online training session “Protect Against Penalties for Non-Compliant Good Faith Estimates.” Healthcare compliance expert Jonathan G Wiik, MHA, MBA, will walk you through the specifics of preparing a correct, compliant Good Faith Estimate so you can be sure you’re in line with the law. Register today!

| Subscribe to Healthcare Practice Advisor | |

| Get actionable advice to help improve your practice’s reimbursement, compliance, and success in this weekly eNewsletter. |

|

|

|