Update 12/16/21: HHS announced on Dec. 13 that the reporting portal would re-open for completion or submission of reporting for Reporting Period 1 from Dec. 13, 2021 at 9am ET through Dec. 20, 2021 at 11:29pm ET.

On September 10th, 2021, HHS announced the availability of $25.5 Billion still available in COVID assistance within Phase 4 of the Provider Relief Fund program. Even if you received financial help previously from this program, you may still be eligible. Also, non-par providers can apply as well.

Additionally, in the same announcement, HHS reported the implementation of a 60-day grace period for reporting of Phase 1 Provider Relief Funds ONLY. The grace period will begin October 1 and end on November 30, 2021. The original September 30th, 2021 deadline hasn’t actually changed, but if you miss this reporting date no recoupment or enforcement action will be taken until after the grace period’s November 30, 2021 end date.

This is an update to the June 11, 2021 HHS posting that finalized reporting requirements and deadlines for Provider Relief Funds.

Attestation of Funds Healthcare Provider Relief Fund

Initially, you are required to attest to receiving your provider relief funds. You have 90 days from the date that you received the money to agree to the terms and conditions of the funds and to your receipt of them.

Four payment periods were put into place, but the attestation deadlines for the first two periods have passed. Unfortunately, if you failed to meet those deadlines and kept the funds, HHS will automatically deem you as having attested to receiving the money and to its terms and conditions.

Note: You can attest to receipt of your Provider Relief Funds on the HHS website. Currently, you can attest to Phase 2 and/or Phase 3 General Distributions from the first portal in the box titled “Provider Relief Fund Application and Attestation Portal.” For distributions from Phase 1 or Selected Targeted Distributions, you can use the portal in the next box titled “CARES Act Provider Relief Fund Attestation Portal.”

Disbursement of funds began in April of 2020, including:

- Phase 1 – you would have received your funds between 4/20/20 and 6/30/20

- Phase 2 – you would have received your funds between 7/1/20 and 12/31/20

- Phase 3 – you would have received your funds between 1/1/21 and 6/30/21

- Phase 4 – funds are being released from 7/1/21 to 12/31/21

Provider Relief Portal Registration

As of July 1, 2021, HHS’ healthcare Provider Relief Fund Reporting Portal has been open for you to submit your usage data. How you report your information to the Agency can make the difference between being able to keep the money you’ve received or being required to send it back.

If you haven’t already registered on the site, you should do so immediately – this must be done before you can begin the reporting process. Once you’ve registered, you’ll receive HHS notifications regarding PRF reporting to the email you provide.

It’s also important to note that you MUST complete your PRF Reporting Portal registration during one sitting. The site does not allow you to save any portion of an incomplete registration. If you don’t complete your registration before you’re finished, everything you’ve entered will be lost and you’ll have to start from square one.

Reporting Specifications and Deadlines

There are several significant updates to HHS’ Post-Payment Notice of Reporting Requirements document that are important for you to be aware of:

- Fund Amounts: You are required to report on how you’ve used your funds based on each individual payment you receive over $10K. For example, if you received one payment of $5,000 and one of $15,000, you would only be required to report on the $15,000 payment. (Previously, you were required to report on cumulative totals.)

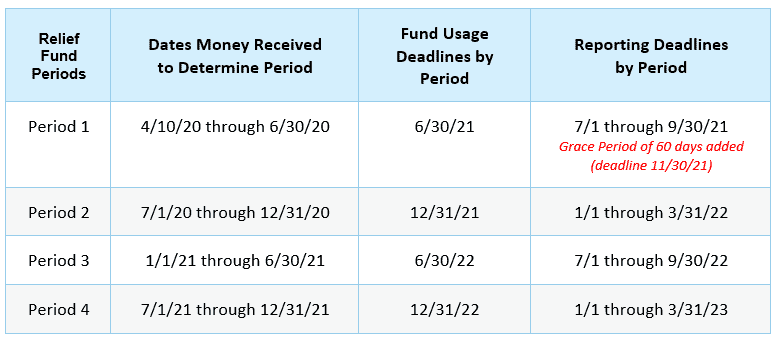

- Fund Usage Deadlines: HHS has revised its deadlines related to when you must utilize the money you’ve received. The deadlines are based on the period in which you initially received each relief fund payment. See the HHS chart below for specific timelines. (The previous reporting deadline for all received funds of June 30, 2021, now only applies to money received in Period 1.)

- Unused Funds: Any funds NOT used by the set period usage deadlines will need to be returned to HHS.

- Fund Reporting Deadlines: HHS has set specific 90-day reporting deadline time slots for each period in which you received a payment. (This was increased from 30-days in the original requirements.)

HHS included the following chart on the Reporting Requirements and Auditing page of their website (slight edits have been made to the column headers for ease of use):

To receive forgiveness for all or a portion of the healthcare Provider Relief Funds that you receive, you MUST take each of the following steps:

- Correctly report how you’ve used the money

- Include the details of when the money was used by

- Submit your data by the deadlines specified by HHS

The Agency has made it clear that misuse of provider relief money will not be tolerated. In fact, the Agency has given themselves three-years to investigate and audit how you used the money.

The recent changes to the rules and deadlines provide you with the “what” and “when” of reporting your healthcare Provider Relief Fund money. The next step is to figure out exactly “how” you should report your information to give you the best chance of keeping the money you’ve received.

This is where healthcare law attorney, Amanda L. Waesch, Esq., can help. Her online training, Keep Your HHS Provider Relief Money will walk you through the submission process. This 90-minute session will provide you with step-by-step guidance on how you can correctly adhere to the newly released reporting requirements to ensure you keep as much of your PRF money as possible. Don’t delay! Sign up for this session now.

| Subscribe to Healthcare Practice Advisor | |

| Get actionable advice to help improve your practice’s reimbursement, compliance, and success in this weekly eNewsletter. |

|

|

|